The Loan Committee at Sturgis Bank & Trust Company faced a two-fold challenge:

- Switch operations to virtual mode practically overnight because of COVID-19.

- Deal with an increased amount of loans that needed to be processed faster than ever.

In short, the 115-year-old organization had to become more nimble … immediately. Spoiler alert: thanks in part to OnBoard, they did it. We’ve written a full case study on how, and a short summary follows below.

“OnBoard made us much more nimble. I’m approving loans on Saturday morning while I’m having my coffee, or on Sunday night while sitting on the couch. I don’t have 50 loans to pick up and take care of on Tuesday because we’ve had those approved during the week.”

Jason Hyska

Senior Vice President, Retail Lending

Sturgis Bank & Trust Company.

The Challenge

Based in Sturgis, Michigan, Sturgis Bank & Trust Company has a robust mortgage servicing pipeline, servicing 7,000 mortgage loans and holding $473.3 million in total assets as of January 2020. Loan officers would walk around to procure signatures on a paper-based contract and upward of 100 loans would be approved or denied at an hours-long weekly committee meeting.

Clearly, the traditional loan approval process was no longer tenable.

The Solution

Sturgis found that a suite of capabilities in the OnBoard platform solved their challenges by providing real-time loan approvals from anywhere. Key product capabilities include that were attractive to the bank included:

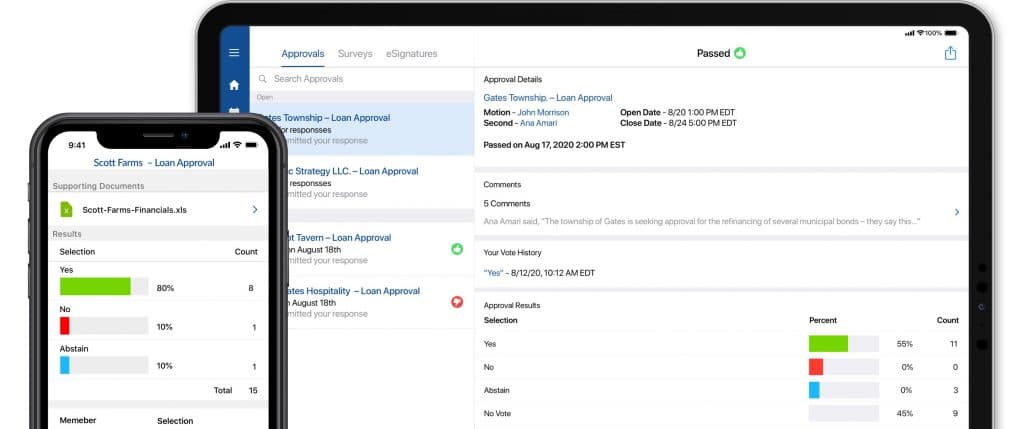

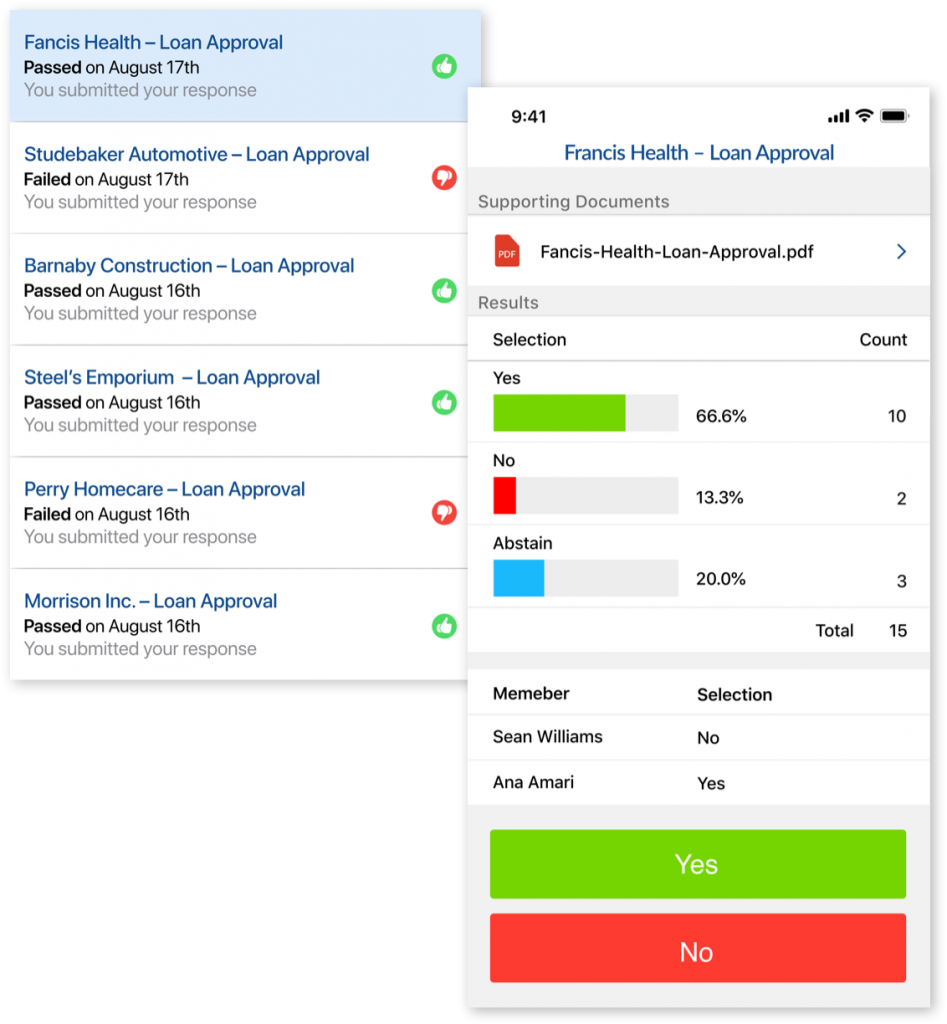

- OnBoard’s secure voting functionality, which allows committee members to signal whether they approve or deny the loan application quickly. The decision is automatically documented to ensure compliance with state and federal banking regulations.

- Real-time instant chat, which allows committee members to ask questions and collaborate in real-time to discuss the application and make more informed decisions.

- OnBoard is available anywhere on any device at any time. Because OnBoard instantly syncs data between every device (including iOS and Android), committee members can work together at any time. There’s no longer a need to delay decisions until a weekly meeting can be held.

- OnBoard’s e-signature feature, which is a boon for processes and documents that require a signature. The eSignatures workflow in OnBoard is a fast, streamlined process where the loan approver is notified when their signature is required. Then they can sign with just one click.

With OnBoard, Sturgis was able to implement a more efficient workflow to replace this time-consuming process. When the committee meets, they find much of their business has been accomplished before they arrived – meeting time shrank by 75% from two hours to about 30 minutes.

“OnBoard made us much more nimble,” says Jason Hyska, Senior Vice President, Retail Lending for Sturgis Bank & Trust Company. “I’m approving loans on Saturday morning while I’m having my coffee, or on Sunday night while sitting on the couch. I don’t have 50 loans to pick up and take care of on Tuesday because we’ve had those approved during the week. That increases turnaround time and increases our productivity.”

“What Onboard has allowed us to do is take a lot of ‘touches’ out of the system. Physical touches are gone. We still have the proper documentation, but instead of a paper going here and a paper going there, now it’s all centralized through one place.”

JASON HYSKA

SENIOR VICE PRESIDENT, RETAIL LENDING

STURGIS BANK & TRUST COMPANY.

The Result

In the wake of the spread of COVID-19, Sturgis had to quickly adapt to virtual operations. But where many struggled to adapt to a remote workflow – the Sturgis team found it an opportunity.

By leveraging OnBoard’s anywhere functionality, the bank has been able to work quickly even from afar to tackle its growing pipeline. From a deluge of refinancing requests to requests for forbearance, they’ve capably dispersed new loans and garnered the goodwill of their customers.

The bank credits OnBoard for helping keep employees and customers connected and processes streamlined even as COVID-19 and social distancing have kept everyone physically apart.

“What Onboard has allowed us to do is take a lot of ‘touches’ out of the system,” says Jason. “Physical touches are gone. We still have the proper documentation, but instead of a paper going here and a paper going there, now it’s all centralized through one place.”

What To Do Next

About The Author

- At OnBoard, we believe board meetings should be informed, effective, and uncomplicated. That’s why we give boards and leadership teams an elegant solution that simplifies governance. With customers in higher education, nonprofit, health care systems, government, and corporate enterprise business, OnBoard is the leading board management provider.

Latest entries

Board Management SoftwareJuly 26, 20225 Critical Board Engagement Survey Questions

Board Management SoftwareJuly 26, 20225 Critical Board Engagement Survey Questions Board Management SoftwareJuly 19, 2022What is an Advisory Council? (Overview, Roles, and Responsibilities)

Board Management SoftwareJuly 19, 2022What is an Advisory Council? (Overview, Roles, and Responsibilities) Board Management SoftwareJuly 15, 2022Balance Sheet vs. Income Statement: What’s the Difference?

Board Management SoftwareJuly 15, 2022Balance Sheet vs. Income Statement: What’s the Difference? Board Management SoftwareJuly 12, 2022Sweat Equity: Mark Haas of the Dallas Cup Board Gives a Nonprofit Play-by-Play for Success

Board Management SoftwareJuly 12, 2022Sweat Equity: Mark Haas of the Dallas Cup Board Gives a Nonprofit Play-by-Play for Success